malaysian taxation question and answer

Income tax is collected on all types of income except. Section A BOTH questions are compulsory and MUST be attempted Section B TWO questions ONLY to be attempted Tax rates and allowances are on pages 24 Do NOT open this paper.

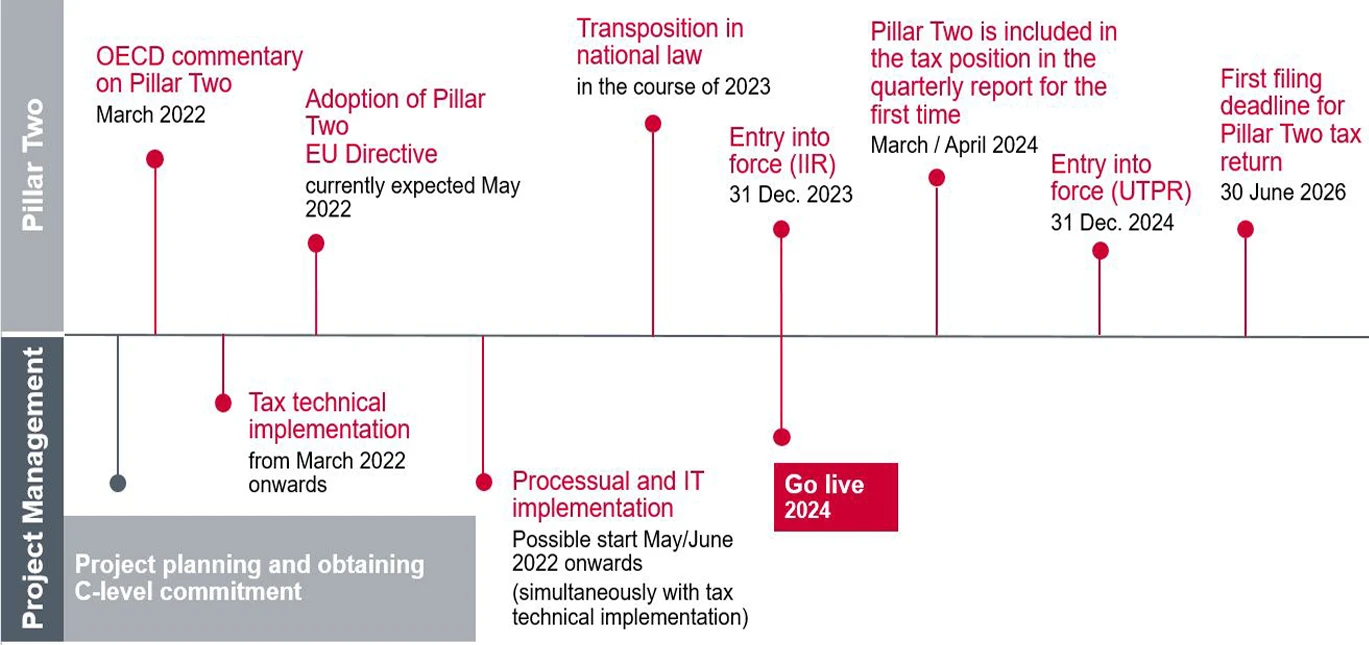

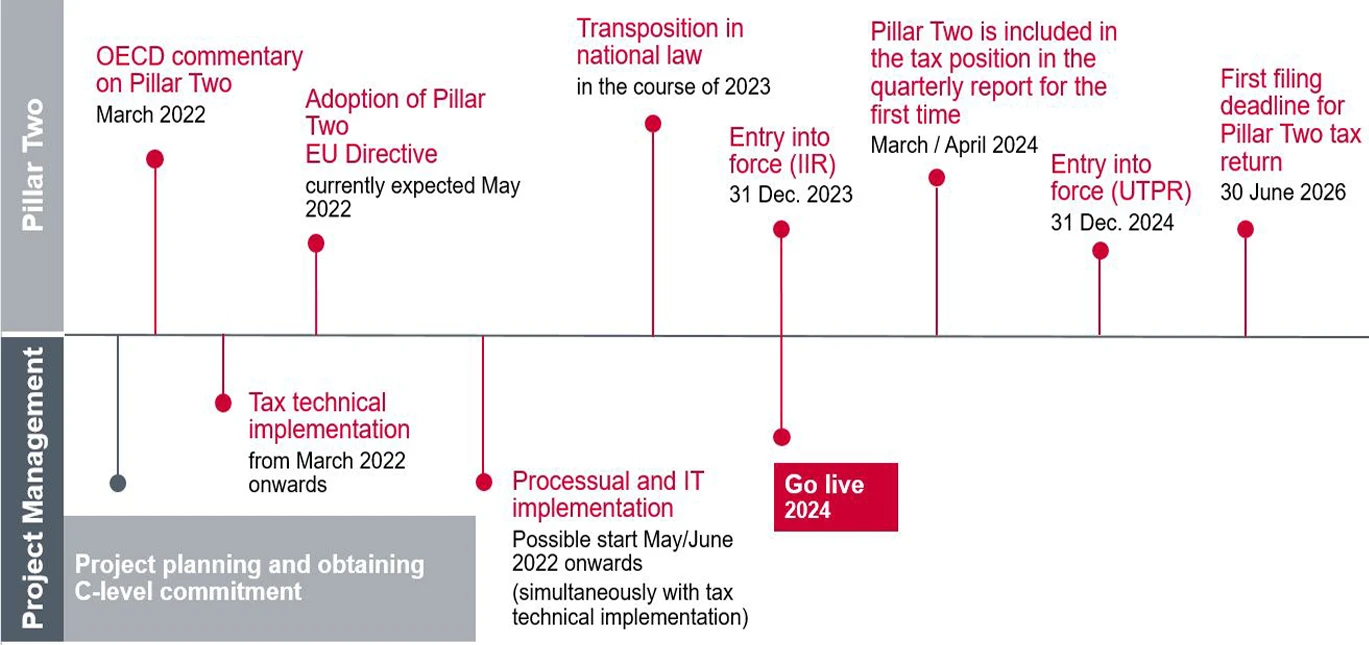

Key Actions For Tax Leaders On Global Minimum Tax

Malaysian Taxation Industrial Building Allowance IBA QBE Question and Answer.

. Exam 5 June 2014 questions and answers. Partnership Malaysian Taxation Question and Answer 18 Jan 2021. Do NOT open this paper until instructed by the supervisor.

Partnership Malaysian Taxation Question and Answer 18 Jan 2021. A tax system will be regarded as. Question and Answer of Finance and Taxation PTPTN Loan Repayment.

Life Fund RM000 Shareholders Fund RM000 General Fund RM000 Gross premiums 25000 - 10000. MALAYSIAN TAXATION Question 1 USE TAX RELIEF 2018 If it requires PLEASE TRY TO DO IT QUICKLY Dania a Malaysian resident is married with 3 child. Malaysian Taxation Question 1 A.

Applied Skills TX MYS March 2020 Answers Taxation Malaysia TX MYS and Marking Scheme Section A 1 The correct answer is. MANAGING FINANCE AND TAXATION. This question paper is divided into two sections.

Taxation TX Past exam library Malaysia MYS To view PDFs of past exam papers for Malaysia please select from the list below. Answer TO PAST YEAR IBA. 15 Questions Show answers Question 1 30 seconds Q.

Question and Answer of Finance and Taxation. Answer of Malaysian Taxation Question 1 A. THE MALAYSIAN ADMINISTRATIVE MODERNISATION AND MANAGEMENT.

User Manual User Manual About Us About Us. Business Taxation Multiple Choice Questions INCOME TAX ACT 1961 1. Business Taxation Multiple Choice Questions.

Nevertheless before the creditor files a bankruptcy notice in court. There are only two history of Malaysia Taxation are Income Tax Ordinance 1947 and Sarawak Inland Revenue Ordinance 1960. Taxation Multiple Choice Questions MCQs Test with Answers.

Bahasa Melayu BM Register Login. The Malaysian Insolvency Department has no jurisdiction over this matter. Performanceof Takaful Insurancein Malaysia.

Taxation MCQs Questions and Answers. It depends on the creditors. 1 and 2 only.

Malaysian taxation question and answer nov 2019 question and answer part 1. April 2019 Q PAS2333 Taxation 2. Seribayu Enterprise is a partnership business owned by Seri and Bayu engaged in supplying fresh flowers to.

15 Questions Show answers Question 1 30 seconds Q. Tax rates and allowances are on pages 24. Taxation MCQs Questions and Answers.

May I pay less than. During reading and planning time only the question paper may be annotated. A tax that takes a larger percentage from high-income earners.

To practice TX MYS exams in the CBE environment you can. Seribayu Enterprise is a partnership business owned by Seri and Bayu engaged in supplying fresh flowers to customers in Kuala Lumpur and.

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

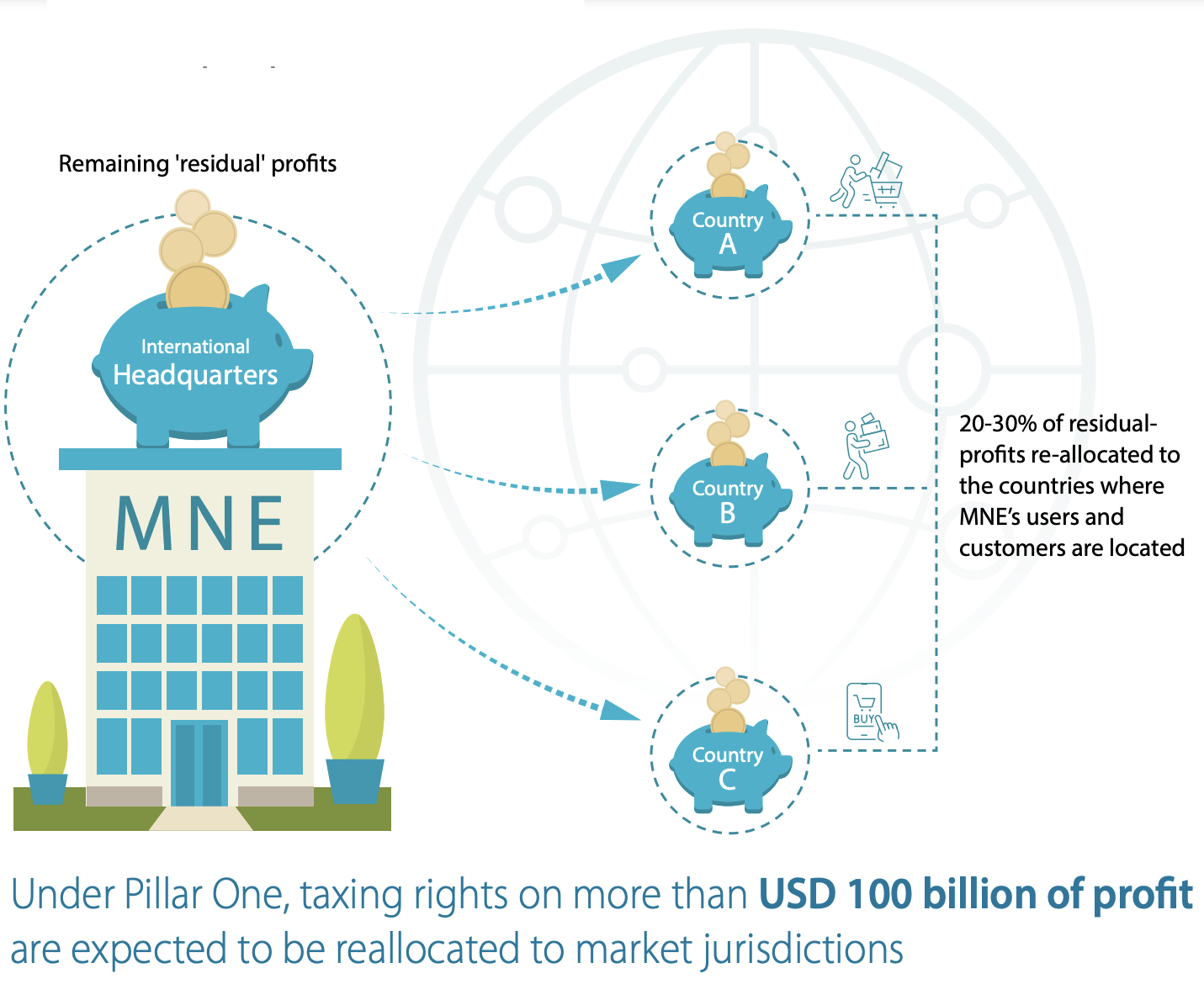

Digital Taxation In 2022 Digital Watch Observatory

Digital Taxation In 2022 Digital Watch Observatory

Why Single Out Energy Companies For Windfall Tax Business Economy And Finance News From A German Perspective Dw 09 06 2022

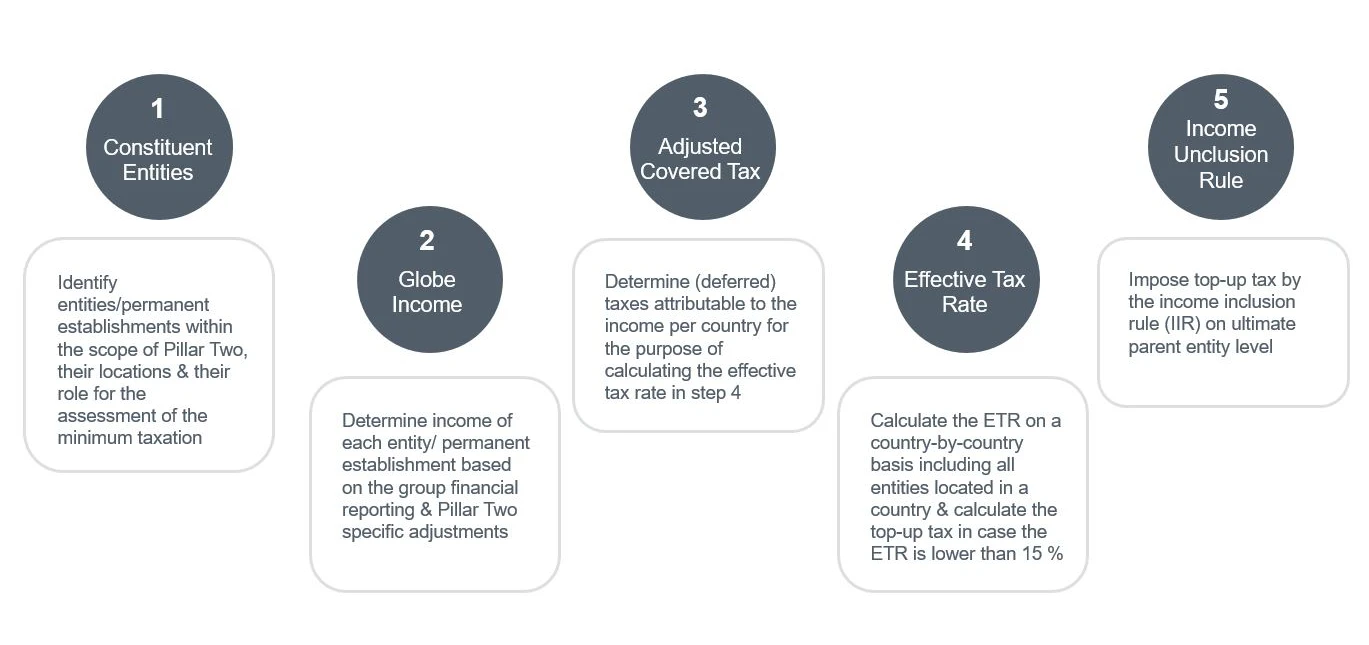

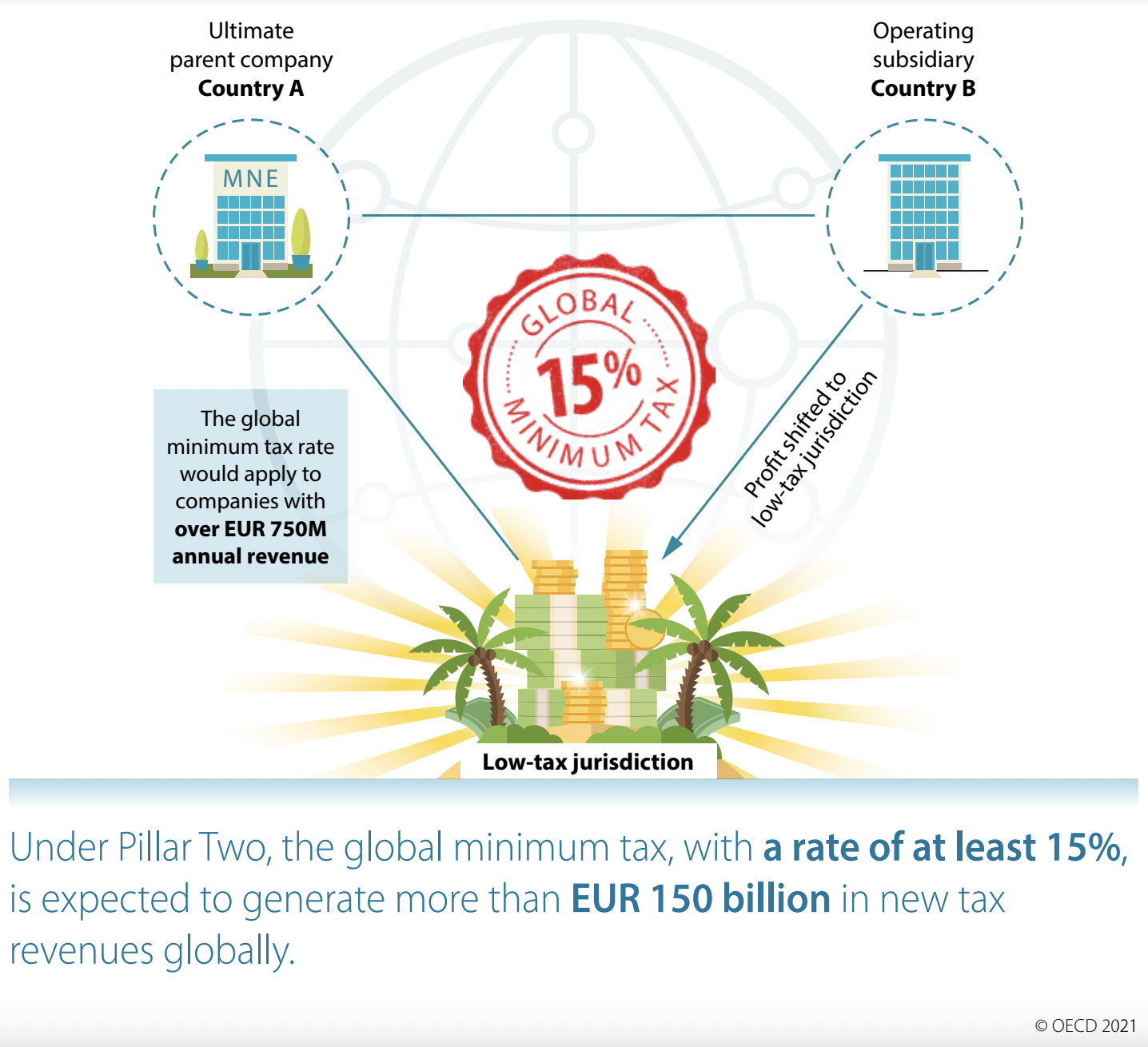

Pillar Two Global Minimum Tax Wts Global

Minimum Corporate Taxation Questions And Answers

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Minimum Corporate Taxation Questions And Answers

Nre Vs Nro Vs Fcnr Which Savings Or Fixed Deposit Account Nri Should Open Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

Why It Matters In Paying Taxes Doing Business World Bank Group

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

Taxation Assignment Help Assignment Help Australia Uk Usa Malaysia 9 5 Page On All Writing Assignments Helpful Writing

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Pillar Two Global Minimum Tax Wts Global

Pillar Two Global Minimum Tax Wts Global

Digital Taxation In 2022 Digital Watch Observatory

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)

0 Response to "malaysian taxation question and answer"

Post a Comment